August 5, 2024:

CFOs are taking a more assertive role in IT decisions in Australia and New Zealand in 2024.

Research from enterprise software solutions firm Rimini Street shows that CFOs are now often the ones guiding underlying technology decisions — a responsibility traditionally held by company CIO’s.

The research, C-Suite Imperatives: Evolving IT and Enterprise Investments, surveyed 250 CFOs and CIOs in the ANZ region. It revealed that closer collaboration is improving CFO and CIO relationships, which could result in higher IT budgets and business return on investment.

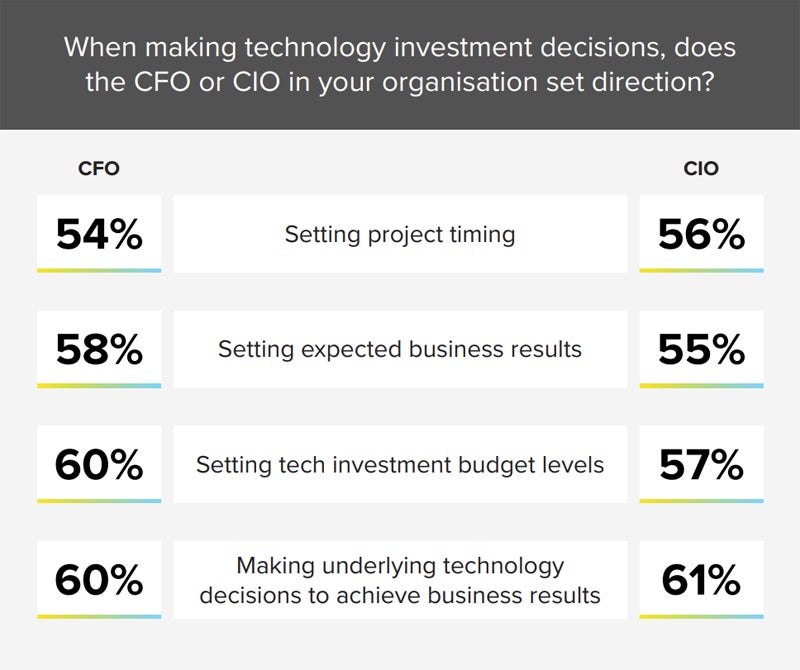

CIOs once had primary responsibility for the tech decisions made by enterprises. However, Rimini Street’s research found 60% of CFOs say they are the ones responsible for underlying technology decisions to achieve business results, marking a shift in how decisions are made.

Specialist IT research firm ADAPT Research has also noted this trend. ADAPT’s strategic research director, Matt Boon, estimated at a recent Sydney conference that CFOs are now involved in 70% of all IT investment decisions. He said this level was “the highest we’ve ever seen.”

CFOs aren’t the only ones who notice this shift. CIOs agree that their CFO counterparts are the ones making the underlying technology decisions and taking the lead role in setting technology investment budget levels.

The increased focus on financials in Australia and New Zealand is no secret. The market has seen rising inflation, higher interest rates and slower business growth. IT leaders in the region have been under pressure to do more with the same or less or face slower budget increases.

Resource: How CFOs have evolved from number crunchers to value drivers

The environment has drawn CFOs closer into technology oversight and decision-making. CFOs have been concerned about cost, as elements like rising cloud costs impact the bottom line. They are also interested in the contribution technology investments make to business growth.

The Rimini Street report showed that only 23% of CFOs are happy with the impact tech investments are making on their business goals — a major reason why they’re more involved in tech decisions. That leaves about 3 in 4 CFOs who aren’t completely pleased with the results of their legacy tech investments or who don’t think that IT investments are tied to business goals.

In fact, many CFOs have scathing feedback when asked about organisational technology. Among surveyed CFOs:

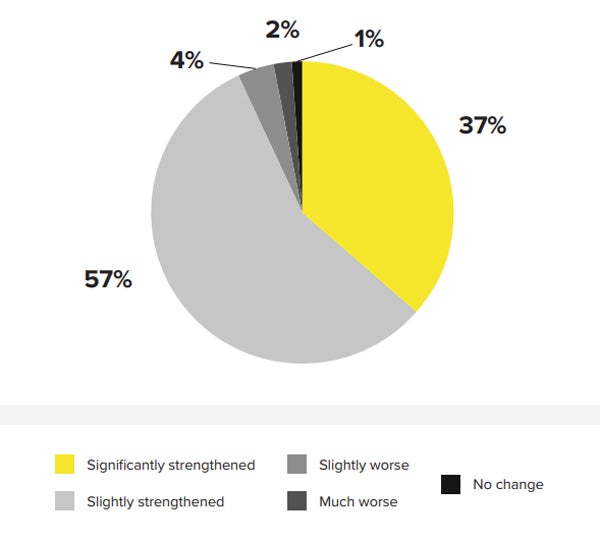

Despite some CFO dissatisfaction, 94% of respondents said the CFO and CIO relationship has strengthened significantly or slightly. This is a large percentage considering the CFO is increasingly encroaching on some of a CIO’s traditional responsibilities.

Closer collaboration is tipping CFO perception of CIOs toward the positive. The survey found:

Rimini Street said these skill sets go beyond the core technology strength of most IT execs.

“It speaks to leadership and collaboration more so than technology proficiency, indicating at least on the CIO side, they are learning the CFO’s language,” according to the report.

An uncertain business environment has been a factor in the strengthening relationship between CFOs and CIOs, as they have been required to work closely together. According to the Rimini report, some of the reasons nominated by CIOs and CFOs for the stronger bond were:

Rimini Street said CFOs remain dependent on CIOs because of the complexity of IT decisions and want CIO guidance with priorities rooted in technology, such as security and emerging technologies. CIOs are looking to CFOs to assist them with budget and executive advocacy.

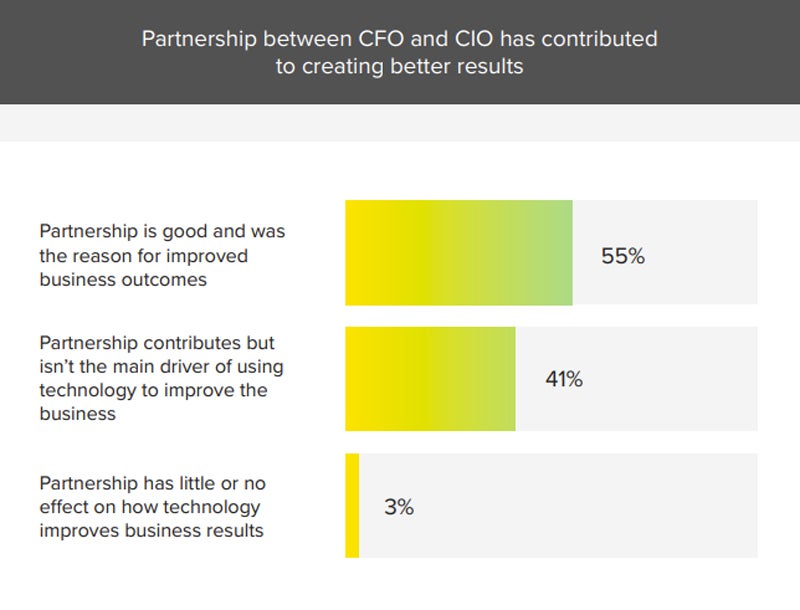

More than half of CFOs in the ANZ region (55%) believe a positive CFO-CIO relationship has been instrumental to better business outcomes. A significant 41% think the partnership contributes, even if it’s not the main driver of improving business results.

The CFO and CIO relationship can still improve. For example, both CFOs and CIOs think the other should better understand their discipline:

A small percentage (6%) of CFOs report having a worse relationship with their CIO. Among these CFOs, 38% attributed the issue to a lack of expertise in addressing security, compliance and risk issues, while another 38% cited the CIO’s inflexibility in identifying ways to cut IT costs.

Other reasons for CFO dissatisfaction included CIOs demonstrating a frustrating lack of urgency (23%), presenting plans that did not demonstrate adequate return on investment (23%), or not welcoming more proactive engagement (23%). These issues indicate that both skills and working styles could both be relationship flashpoints.

Savvy IT leaders have the potential to better leverage blossoming CFO relationships to advance the interests of IT within the organisation — particularly when it comes to budgets and investment.

IT budgets are expanding as a percentage of overall revenue, with 79% of respondents to Rimini Street’s report saying they are increasing. As IT balloons in importance, both in terms of cost and as a business-value driver, CIOs should expect increased involvement and scrutiny from CFOs.

SEE: Four proven ways to expand your value as a CIO in 2024

Rimini Street added that CFO dissatisfaction with tech investments could lead to increased involvement.

“This [CFO dissatisfaction] is a clear signal for CIOs to expect a heightened level of collaboration with their business counterparts, as well as to prepare for increased oversight to ensure that their tech choices are driving business value,” the report said.

CIOs can benefit from better understanding how CFOs assess the merit of new technology investments. As expected, Rimini Street found CFOs are more focused on the financial impact of investments. The top five factors considered by CFOs in tech investments are:

CFOs may have different ideas about what CIOs should focus on. For example, the research found CFOs want CIO priorities to include risk management and compliance, customer success and engagement, major ERP reimplementation and migration, and revenue-generating technology.

CIOs may have a different opinion from their CFO when discussing technology-related decisions — especially given the importance of risk management and compliance for CFOs. But Rimini Street said CIOs can be confident that, on the whole, CFOs are driven more by results and return on investment than they are by the technology itself.

CIOs are largely interested in emerging technologies: 64% of CIOs surveyed are already investing in artificial intelligence, while an additional 28% plan to invest this year. However, they do understand the need to be cautious, with 34% saying they are only supplementing existing enterprise technology rather than investing in new innovations.

SEE: 3 best practices for CIOs using emerging technology for business results

This caution could further support the CFO-CIO relationship. Rimini Street found that CFOs were not necessarily opposed to the introduction of emerging technologies, but they indicated they want to ensure they get the maximum value from new technology.

CIOs stand to benefit from the growing collaboration with CFOs. The report found that, if a CIO was to approach a CFO with a reasonable IT investment proposal that could demonstrate ROI, 23% of CFOs would be willing to approach the board to secure the required funding.

This bodes well for CIOs into the future. With a need to remain agile and invest in new technologies like AI to keep businesses competitive, support from CFOs and a strong relationship foundation could be the fulcrum for future business success.