April 8, 2024:

Do you qualify?

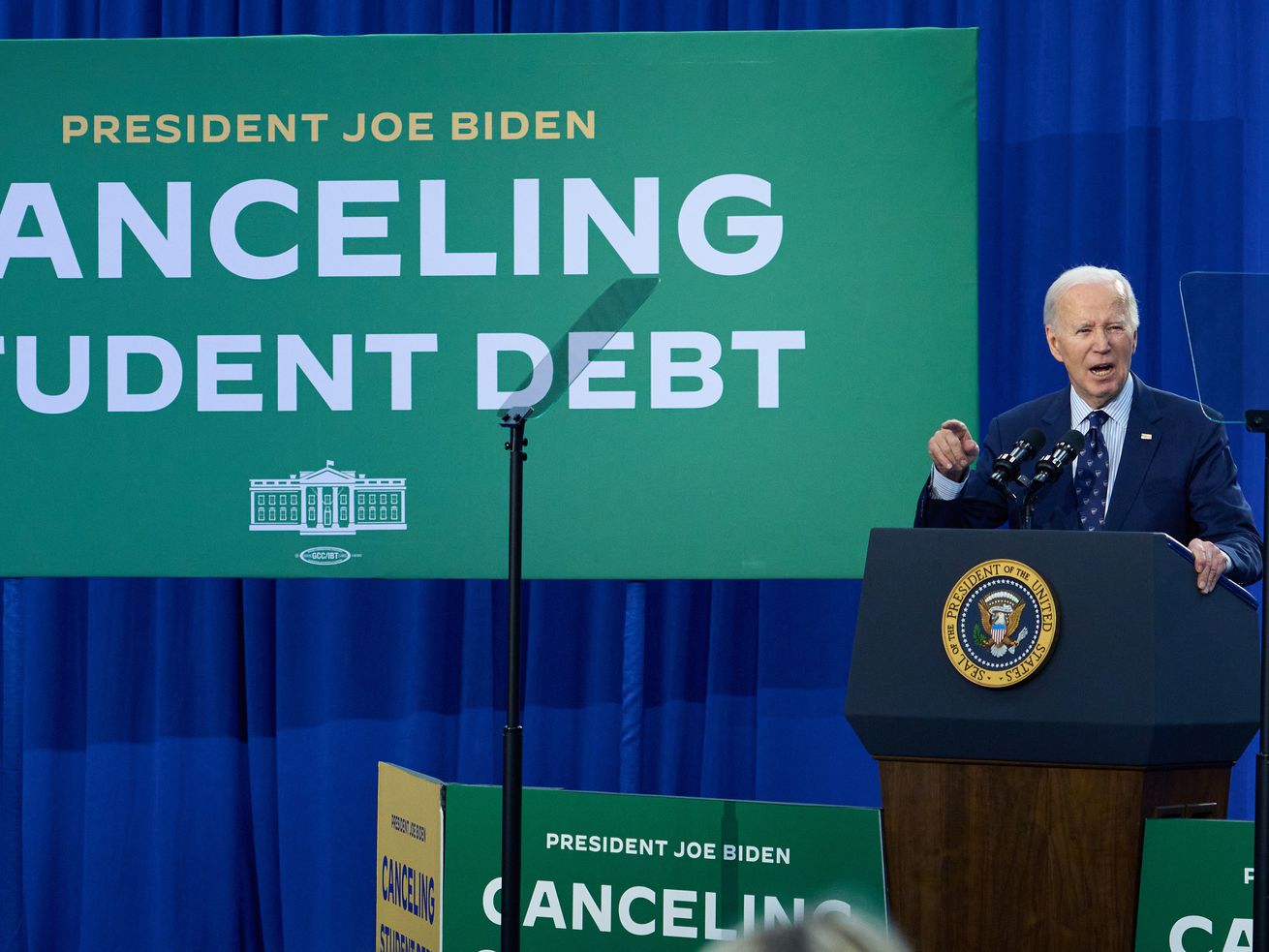

Nearly a year since the conservative majority on the Supreme Court struck down the Biden administration’s sweeping attempt to forgive student loans, the White House is now announcing more specifics on its Plan B.

This second attempt is less all-encompassing than the first, which would have forgiven up to $10,000 in debt for most borrowers, but it’s still pretty ambitious. Plan B invokes a different legal authority than the one used in 2022, builds off existing programs that haven’t faced the same kind of legal pushback, and is much more targeted, all in an attempt to avoid the fate that the first loan forgiveness plan faced at the Supreme Court.

Still, the Biden administration is likely to face opposition from Republicans and conservative critics, who may try to use the federal court system again to derail the plan. It’s also unclear whether voters, especially younger ones, will give Biden credit for this attempt since it largely applies to borrowers who have had debt for a long time, like millennials and Gen Xers.

Combined with other loan forgiveness plans implemented during President Joe Biden’s term, Plan B would, according to the White House, relieve debt for more than 30 million Americans. Under this new plan, more than 4 million Americans will have their entire debt canceled and 10 million more would see at least $5,000 of relief. Another 23 million would have their accrued interest, the additional debt that borrowers have been saddled with on top of the principal, wiped away.

Any relief is likely at least a few months away. The plan announced Monday is the result of a regulatory process that started a month after the Supreme Court struck down the first plan and it still requires a public comment period before anything can go into effect — meaning that the earliest that debt relief would begin is likely this fall.

This plan would target five kinds of borrowers, and in most cases it would not require them to fill out an application; the Education Department would use data it has on hand to implement the forgiveness once the plans are finalized.

People who now owe more money on their loans than they originally borrowed. These borrowers would have up to $20,000 of debt from interest erased, regardless of their income. They would still have to repay the original amount they owe. Individuals making less than $120,000 a year, or couples making less than $240,000, would qualify to have full forgiveness of their interest.

People who have owed on loans for at least 20 years. If a borrower entered repayment for undergraduate debt 20 years ago or more, they would qualify for full forgiveness. If a borrower of graduate school debt entered repayment 25 years ago or more, they would also qualify.

People who took out loans to enroll in “low-value” academic programs. These borrowers took out loans for institutions or programs that were deemed by the federal government to have low financial value. The White House defines this as programs or schools that “lost their eligibility to participate in the Federal student aid program” or were deemed to have cheated their students, or left graduates with loan payments on earnings after school that were not better than what someone with a high school diploma could earn.

People who would qualify for a preexisting loan forgiveness program but aren’t enrolled in one right now. This option would automatically enroll borrowers who qualify for forgiveness through the revamped income-driven or public service forgiveness programs.

People experiencing financial hardships. This option is a little vaguer, but it is meant to apply to borrowers for whom other forgiveness and repayment programs don’t apply. Hardships include medical debt, expensive child care, and those at risk of default.

What makes this approach to student loans different is the focus on accrued interest, or what the White House and Department of Education call “runaway interest.” Like all loans, student loan debt consists of a principal (the amount originally borrowed) and interest. When the cost of interest is higher than the amount you’re making in payments, the interest gets added to the balance of the loan. Then you end up with the amount you owe over time, which can keep growing, even if you’re making regular payments.

That additional interest is often added to the principal, making future interest charges even larger. The White House has already implemented changes to the way interest is capitalized — or added to the principal balance and generating even more interest — and this plan builds off those regulatory changes to forgive interest entirely.

Biden and his administration are spending Monday touting this new plan in key cities, including in swing states. The president is in Madison, Wisconsin, while Vice President Kamala Harris is heading to Philadelphia, her husband is traveling to Phoenix, and Miguel Cardona, the secretary of education, is meeting with borrowers in New York City.